Lock a debit cardadatext to forestall unauthorized use, request a digital cardadatext and more. Set alertsadatext for account changes, like uncommon exercise, funds and more. This account provides a limited on-line expertise on your child.

IRA CDs and IRA savings accounts are two kinds of financial institution accounts you should use in your retirement financial savings technique. Restrict one cash bonus per buyer Taxpayer Identification Number (TIN)/Social Safety Quantity (SSN) whatever the variety of checking accounts opened. Recipient(s) (customer TIN/SSN) of money bonus shall not be eligible to obtain a money bonus on any other personal checking account. A direct deposit is an digital deposit of your paycheck or authorities benefits, corresponding to Social Security, Disability, and so on. A checking account is for using your money for everyday wants, like making purchases or funds.

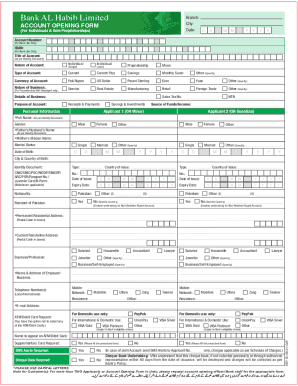

Use your hard-earned cash properly with our numerous vary of checking accounts. We perceive that everybody’s monetary needs and targets are unique, which is why we provide several distinct checking account options1. Each checking account is filled with different options and rewards, designed to provide a secure home in your cash. Open a checking account with us at present and experience a tailored banking resolution that fits your monetary wants. Interest-bearing checking accounts often require a higher minimal opening deposit. Banks often supply payment waivers should you make bigger initial deposits or maintain larger balances.

Advantages Of Enterprise Financial Institution Accounts

Your account will only Immigration and Relocation Services for Living and Working in UAE receive an curiosity posting if the amount earned in the course of the month rounds to at least $0.01. Banks might waive sure fees specifically circumstances, such as maintenance fees which are eliminated when you have an computerized deposit or meet a minimum balance. Your checks and scheduled funds will be declined or returned unpaid.

Find an account that matches your financial needs, from dependable on an everyday basis use to the highest premium perks. Find out earlier than you make your transaction if there is a time restrict for submitting a refund declare within the occasion of delayed fee or failed delivery. Widespread sense is your finest information to utilizing an ATM safely.& If you think you studied something isn’t fairly right, belief your instincts. Use an ATM or a financial institution department where you are feeling more comfy. Chase has the largest department network within the U.S with hundreds of ATMs and branches.

- A checking account is designed for on a regular basis transactions like spending and invoice funds, offering easy accessibility to your funds.

- Choosing a financial institution that offers accounts with higher-than-average interest rates is normally a big benefit, since larger rates can present a boost as you work toward your monetary goals.

- Bankrate researches over one hundred banks, together with a variety of the largest monetary institutions, online-only banks, regional banks and credit score unions with both open and restrictive membership policies.

- We won’t charge a charge for the returned objects, however the payee may.

A lot of banks will let you switch cash from one checking account to a different, from savings to a checking or vice versa, or to someone else who makes use of the same financial institution dubai id card. You might even have the power to wire cash to an individual or firm that doesn’t have an account with that financial institution. If you are the kind to use an ATM to withdraw money and deposit checks, you will likely save time by choosing a financial institution with an ATM near your own home, work, or kids’ college.

They open a checking and savings account at a financial institution that gives them a favorable introductory offer and has low fees. For all different Financial Institution of America checking accountsIf you’re applying with someone beneath age thirteen, you must apply at a monetary heart. CDs are a sort of bank account that commonly offers a higher rate of interest than a traditional financial savings account. You’ll earn a set amount of curiosity in trade for securing your funds for a sure time period size, according to Bessette. When opening a CD account, understand that if you wish to withdraw funds earlier than the end of the term you’ve agreed to, you will likely face a penalty.

Faqs About This Chase Complete Checking Offer

UMB’s one-on-one financial coaching might help you get essentially the most from your banking expertise. Checking made simple – match for your on a regular basis banking needs. One (1) free box of Colonial Traditional 50 pack each six months, restrict two (2) per yr. The Axos ONE® Checking account will earn a base fee of 0.00% APY. The Axos ONE® Savings account will earn a base rate of up to 1.00% APY.

Perk: Unlimited Atm Payment Reimbursements

UMB’s accounts work seamlessly with the latest https://execdubai.com/ digital wallet expertise, together with Google Pay, Apple Pay, Samsung Pay, and Garmin Pay. For detailed directions and easy-to-use types, be taught extra about your swap to Wells Fargo. Teens with no primary ID have to be accompanied by an grownup co-owner, who is a relative or guardian, and produce a secondary ID, such as a Social Security card, birth certificates, or pupil ID. We accept all kinds of IDs to help you meet these necessities. Designed for comfort and backed by FDIC insurance coverage, your money is secure and at all times within reach.

Am I In A Position To Open A Checking Account Online With No Deposit?

A financial savings account is for setting aside money for longer-term goals. Savings accounts earn interest and may provide an ATM card for making deposits and getting cash. ” is a crucial https://martabak188.gold/dubai-multiple-entry-visa-cost-2025-30-60-day/ question to assume about when you’re able to take control of your finances.